Banks have been around for centuries, whereas social media has only existed for a little over a decade. So it’s no surprise that the two have not always intersected.

However, in recent years social media has become an increasingly useful tool for banks.

In this blog post, we will discuss how banks can use social media to their advantage. We’ll look at the different ways social media can be used to engage customers, build relationships, and promote products or services. We’ll also explore some of the challenges of using social media for banks.

Why should banks use social media?

Perhaps the most important reason is that social media provides a way to build relationships with customers.

Nowadays, when there are so many choices for banking products and services, customer loyalty is no longer a given. In the past, banks typically communicated with their customers through advertising, calls, and direct mailings. Thanks to social media, banks can now engage in two-way conversations with their clients. This allows them to give feedback to the banks about their wants and needs.

It is also possible to use social media for promotion without being invasive. Such platforms make it easier for banks to keep their customers informed about new products and services. Banks can capture their target audience this way and focus their promotions to specific groups of customers on social media.

For example, if a bank is launching a new savings account, they can target their promotion to customers who have expressed an interest in saving money.

How can banks use social media?

How social media is used in the banking sector is a topic of much debate.

Some banks believe that social media should just be used for customer service purposes, while others only leverage it to drive sales and increase profits. While some banks choose to be active on a single platform, others embrace the concept of omnichannel marketing.

There is no one-size-fits-all approach to fit, but there are some ways that banks can use social media to their advantage regardless of which side of the debate you fall on:

- Customer service – social media provides a way for banks to deliver it in real time. Social media customer service allows them to quickly resolve customer issues and improve the overall customer experience.

- Product promotion – as we mentioned earlier, social media can be used to promote products and services. Banks can use it to share information about new offerings, as well as special promotions.

- Lead generation – social media can be used to generate leads for new products and services. For example, a bank could use social media to promote financial education training among its users.

- Engagement – social media helps banks to engage their customers. Banks can then get feedback from their customers and learn about their wants and needs.

And that’s just to name a few.

Challenges of social media for banks

Social media can be an excellent tool for banks, but it does not come without its challenges.

1. The need for social media policies

Because social media is still a relatively new phenomenon, many banks have yet to develop social media policies. It can thus be difficult for them to know what is and is not acceptable for employees to post on social media, or how to run social media profiles in general.

Moreover, social media policies can vary from country to country. This makes things even more complicated, especially in the case of larger, multinational banks.

2. Handling complaints and negative comments

Social media is public, so it provides a perfect way for customers to voice their displeasure with a bank’s products or services. It goes without saying that negative feedback can damage a bank’s reputation if not handled properly. That being said, banks need to have a plan in place for how to deal with negative comments and address complaints.

3. Protecting customer data

There is always the risk that customer data could be hacked or leaked via social media. This is a serious concern for banks because it may lead to identity theft or other financial crimes.

To protect their customers’ data, banks need to have strong security measures in place. They also need to make sure their customers don’t share sensitive data (e.g. card numbers) on the bank’s social media channels, as they won’t be secure.

4. Responding to crises on social media

In the event of a crisis, social media can be a double-edged sword for banks.

On one hand, social media helps banks to quickly and easily disseminate information about the crisis. On the other hand, social media also provides a platform for people to express their frustration with how the bank is handling the crisis or operating in general, which can lead to more negative publicity.

As a result, it’s important for banks to prepare themselves for crisis situations that may arise on social media before they occur.

5. Legal restrictions

There are a number of legal restrictions that banks need to consider when using social media. For example, banks are not allowed to share certain types of information about their customers (e.g. their credit scores).

Additionally, there are a number of regulations that banks need to comply with when it comes to advertising and marketing on social media. In some countries, a digital imprint is required for social media ads. In others, some banking products like payday loans or cash loans are not allowed to be advertised on social media.

Banks need to be aware of such legal restrictions and make sure they are fully compliant with them.

Social media for banks: good practices

Identify the key objectives for your bank’s social media presence

Take some time to think about your goals. What do you want to achieve with social media? Do you want to use it for customer service, to generate leads, or for building brand awareness? Once you’ve identified your objectives, you can create a social media strategy that will help you accomplish them and set your social media KPIs.

Choose the social media platforms that are right for your bank

Consider which platforms your target audience is using and make sure you have a presence there. Sometimes, it’s better to start small and make sure that you choose the right social media platform for your audience. Start with one or two platforms instead of trying to accommodate all of them straight away.

You should use:

- Facebook, if you want to build relationships with your customers and create a community around your brand.

- Twitter, if you want to provide customer service or share timely updates about your bank.

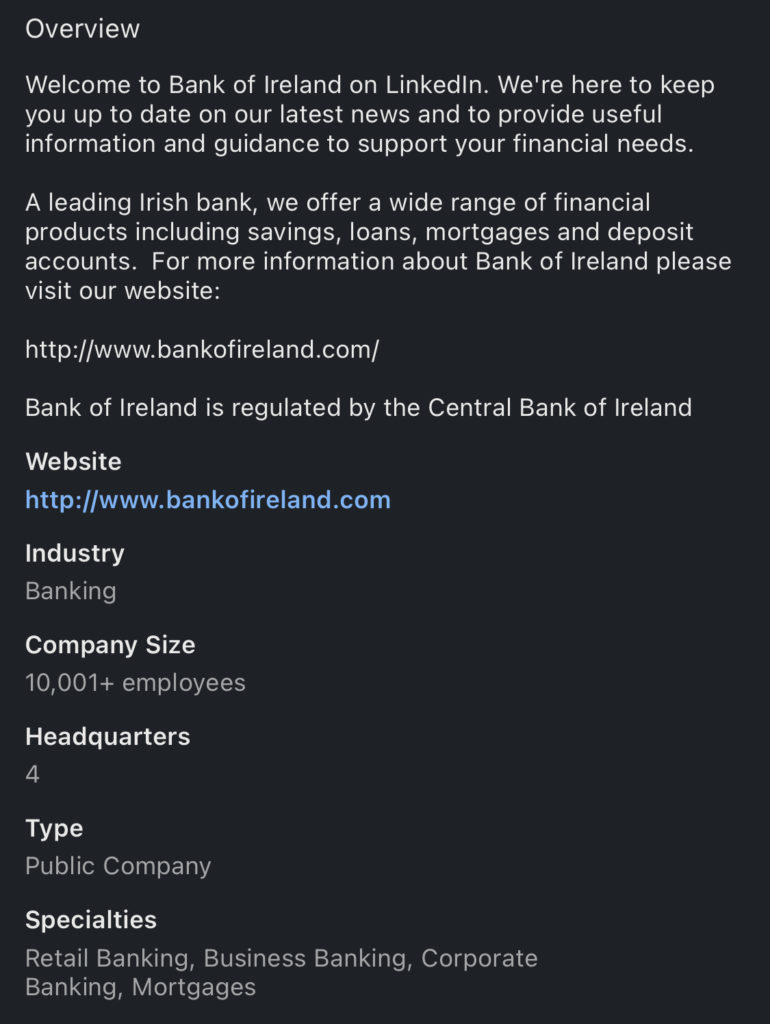

- LinkedIn, if you want to connect with other businesses or industry thought leaders.

- Instagram, if you want to build brand awareness or show the human side of your bank.

- TikTok or Snapchat, if you want to reach younger audiences.

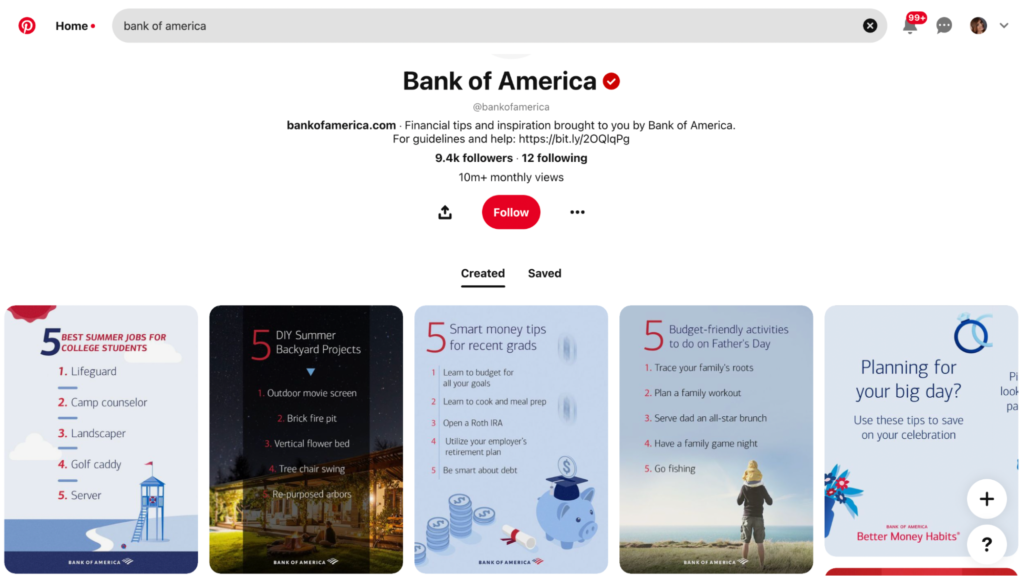

- Pinterest, if you want to share infographics or other images.

Encouragement for trying Pinterest? Bank of America, one of the world’s largest banks, has over 9 thousand followers on Pinterest and attracts more than 10 million monthly views on its Pins. Not too bad, right?

Always pay attention to what social media platforms your audience spends the most time on. If you feel like you need to expand or want some inspiration, we created a list of the best social media platforms for 2022.

Create attractive, user-friendly profiles that represent your brand

When creating your bank’s social media profiles, ensure they are attractive and easy to navigate. Make sure your branding matches the rest of your marketing materials and use high-quality images.

You should add to your profiles:

- full name

- address

- phone number

- email address

- links to your website and other social media profiles

- a brief description of your bank

- your bank’s logo

Your social media profile is often the first thing people will see when they come across your bank on social media, so you want to be sure that it makes a good impression.

Establish social media policies and procedures

As we mentioned before, social media policies can help banks navigate social media challenges. Banks should therefore develop social media policies covering a wide range of topics.

There are a number of things that could be included in such a policy:

- templates for social media posts

- approved social media platforms

- procedures for handling complaints

- crisis management plan

- responsibilities of social media team

- contact details, etc.

Social media policies should be reviewed and updated on a regular basis.

Train employees on how to use social media responsibly

Banks should provide training to their employees on how to use social media responsibly. This training should cover a variety of aspects, including:

- the bank’s social media policies

- how to deal with negative comments

- how to process customer data

- what type of information is and is not allowed to be shared on social media

- what are the do’s and don’ts of social media use

- social media etiquette

With a social media policy and proper training in place, banks can minimize the risks of social media and use it to their advantage instead.

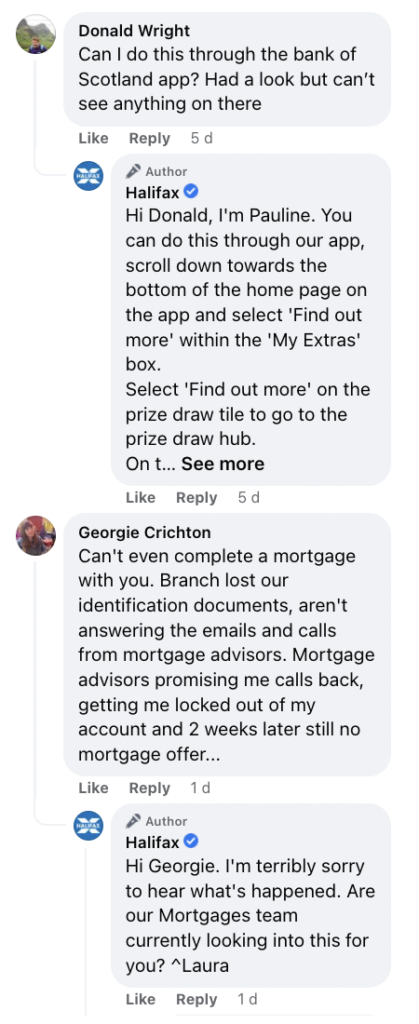

Halifax / Bank of Scotland uses templates on their Facebook profile so their employees can respond to many different queries and questions:

Monitor social media activity for compliance and risk purposes

For compliance and risk purposes, banks should monitor social media on a daily basis. This includes keeping an eye on:

- employee social media activity to make sure they are in compliance with the bank’s social media policy

- customer social media activity to identify potential risks (e.g. fraud)

- social media posts about the bank to identify any negative sentiment

Banks can be aware of the risks and take the necessary steps to mitigate them thanks to social media monitoring. With social listening, banks can also take advantage of social media to understand their customers better, as we’ll get to later.

Respond to customer inquiries promptly and politely

Whether it’s social media posts, comments on them, or private messages, banks should answer customer inquiries as soon as possible. A rule of thumb here is to respond within 24 hours, however, with social media platforms like Twitter, it’s often best to respond in real time.

Banks should also have a social media customer service plan in place, including:

- who will be responsible for responding to social media inquiries (e.g. social media or customer service team)

- how quickly inquiries should be responded to (e.g. within one hour or within 24 hours, etc.)

- what type of inquiries should be escalated to senior management (e.g. complaints or negative sentiment)

By providing prompt and courteous responses to social media inquiries, banks can provide a positive customer experience and build brand loyalty. They can show that they are responsive to their customers’ needs and that they care about the bank’s reputation.

This is useful not only in the case of negative sentiment but also to show potential new customers that the bank is trustworthy. If a particular bank is responsive in terms of regular questions or complaints, it’s likely that they will also be prompt to address any major issues or bugs.

Use social media to build relationships with customers

Social media can make or break banks, which need to be more active online than ever before in today’s social media-driven world. But what does that mean?

For banks, social media is about building relationships with customers. It’s an opportunity to connect with customers on a more personal level and create connections that go beyond financial transactions.

Here are some ways in which banks can use social media to build long-term relationships with customers:

- Share valuable content, e.g. tips on financial planning and money management – by doing so, banks can establish themselves as thought leaders and build trust with potential and existing customers. Create a social media content strategy, so you always know what topics to cover.

- Engage in conversations – this means keeping an eye on social media channels for all mentions of the bank, both good and bad.

- Be human, social media is all about personality – customers want to see the human side of banks, so don’t be afraid to show some personality in your social media posts. Showcase your team by sharing photos and stories.

- Consider community involvement – engage customers in social media contests and campaigns that support a good cause. This is a great way to show that your bank cares about more than just profits.

- Ask for feedback – use social media to ask customers for their opinions on your products and services. This shows that you’re always looking to improve and that you care about the customer experience you provide.

Citibank’s social media profiles remain open for feedback and contact:

Keep an eye on online conversations about your bank and join in when appropriate

With social listening, banks can track mentions of their brand, product, or service and better understand their audiences.

Banks can use social listening to:

- Monitor customer sentiment – this means tracking the emotions associated with mentions of the bank. Are customers happy, sad, angry, or frustrated?

- Identify issues and problems – by monitoring social media channels, banks can quickly identify any situations that need to be addressed. Don’t forget to run a quick social media optimization of your channels from time to time.

- Gain insights into customer wants and needs – social listening can help banks understand their customers’ desires. This information can be used to improve products, services, and the overall customer experience.

Social media for banks – does it make sense?

It goes without saying that social media for the banking industry poses many challenges, yet it can be used to their advantage. By being responsive, engaging, and human, banks can use social media to build long-term relationships with customers. The right social media strategy can help banks understand their customers better and improve the overall customer experience that they provide.

Go and get social – your bank’s future and success may depend on it.