It is essential that finance professionals understand how to use social media platforms in order to stay competitive. You can build your brand, stay current with industry trends, and find new clients through them.

But before jumping into social media headfirst, you need to think about which social network is right for your business, what content to share, and when to share it.

Thanks to this blog post, social media can become more than just another promotional platform for the financial industry and rather a new powerful tool in its marketing arsenal.

Benefits of social media for finance

Raise brand awareness and trust

Financial companies can leverage social media channels to build awareness and loyalty with their customers. For financial companies, they are simply important tools for connecting with their customers.

By leveraging social media, financial companies can grow their market share and enhance their brands. Social media for finance is also an effective method for increasing customer satisfaction, building trust with customers, and generating new leads.

Financial institutions have started using social media effectively because it has emerged as one of the best methods for reaching out to a large number of potential consumers at once. The interactive nature of social networking sites makes them very popular with people from all age groups due to their ability to cater to both individual pursuits and corporate needs.

In recent years, social media networks have been widely used in marketing by businesses due to their potential for online promotions, engagement with customers, and the ability to reach out much more efficiently than via traditional advertising techniques. In addition to providing a new method of engaging customers, social networks offer financial institutions an easy way to share information and run promotions or contests that can generate interest in specific services or products.

Provide better customer service with and via social media

Today, financial institutions use social networks to connect virtually with their clients or post relevant questions and get instant answers from experts in the field through social networking sites like Twitter (for customer service). Through social marketing, consumers can be engaged more effectively across the entire value chain.

When it comes to providing online support, social media provides tremendous benefits because it is not restricted by geography or time zones. With the ability to stay aware of your brand 24/7 without being glued to a computer screen, you will have complete control over your financial marketing efforts.

That was not possible before.

The use of social media channels allows companies not only to interact directly with customers, but also to resolve customer issues in real-time. Financial institutions can employ social media marketing both for customer service and for resolving client complaints and gaining feedback quickly, so that they can repair their reputation if something goes wrong.

In addition to speed, customer support requires accuracy and efficiency. The reason social networks let you offer a high level of support is that users who ask questions on social media receive responses from multiple sources at once (social network teams and people who specialize in handling questions). As a result, your brand is able to resolve issues faster while still maintaining accountability for every complaint raised online via social channels.

Research audiences and gain feedback more easily

Financial institutions can use social media to communicate with their customers and gain insights into their target audiences. A business’s marketing strategy should include social networking platforms because they give companies the opportunity to gain insights into their consumers’ minds.

Businesses can use social media platforms to find out what people really think about them, which helps them better understand how effective their marketing is and whether or not they need to improve in that regard.

You can also generate feedback directly from your target markets to find out exactly when it is time to make product updates or change strategies. Brands can get real-time information about consumer preferences, needs, and wants, etc., thus enabling them to stay on top of industry trends and make quicker decisions.

Social media for finance is a great way to gain access to your most valuable asset: your customers!

Aside from studying consumer behavior patterns, institutions use social networks to see whether it’s time for new services to be offered or to alter current ones.

Lower cost per client acquisition with social media

By using social media for finance, businesses are able to reach a broader audience and acquire customers more cost-effectively.

In order to get their ads displayed on the timelines of targeted consumers, financial institutions can pay for social advertising channels to keep their marketing budgets under control while still gaining exposure for industry-related content online through social media platforms. When it comes to finding information on financial institutions that operate in specific geographic areas, social networking sites make it easier than ever to do so. You no longer need huge marketing budgets to make your brand visible to your target audience!

Social networks allow businesses of all sizes to market financial services as they give organizations the opportunity to reach the right audiences at reasonable costs, based on detailed analyses of each consumer’s general preferences.

Thus, social media marketing has emerged as one of the best ways for firms to advertise their products and services, without having to worry about spending too much money or reaching only a limited number of consumers due to a lack of resources compared to larger competitors.

How to use social media for finance

Be aware of challenges in the finance industry

Being successful with social media for finance is not easy because it requires constant monitoring and participation.

A social network is like a spider web where you need to be present whenever people ask about financial institutions and services, so businesses can’t afford to spend too much time away from their social profiles when their market share depends on how well they play this game.

With social media platforms, companies have access to thousands of people from various cultures and backgrounds, so going above and beyond your competitors might take some effort but will be worthwhile if you want to increase conversion rates! Moreover, social networking sites offer companies a way to directly hear what consumers really think about them, which gives organizations opportunities to improve their products and services.

The journey is not without challenges, though. One of them is to comply with all of the regulations, but for many, social media simply opens up a box of complaints and negative feedback. As such, you need to be aware of this possibility as well.

Introduce a social media policy and train your team

Having a clear Social Media Policy in place is essential to the success of social media in finance, and employees need to be aware of what they must pay attention to. Educating employees about how to use these channels and the benefits of using them is also imperative.

What should be included in a social media policy for finance?

- guidelines for personal and professional accounts – what to post, what to avoid, how to structure the communication (including hashtags)

- templates to use in case of crisis management or customer service requests (+ empathy statements)

- a checklist for preparing any promotional materials (e.g. in some countries you may need a special kind of disclaimer on creatives)

By doing this you’ll avoid any misunderstandings or wrong moves made by employees who might cause damage due to their lack of knowledge about the social media policy used by your company. You’ll also eliminate potential risks associated with using too much publicly available information on your customers or company, so make sure to train your personnel on social media policies.

Check compliance rules and regulations

This is one of the most important elements of social media management in the financial sector. Social networks differ greatly from other media in that they’re dynamic and cannot be controlled. It is imperative to have a Social Media Policy, but that is only the first step. Before using Social Networking Sites for marketing purposes, companies need to check that their online strategy complies with all legal and compliance rules and regulations imposed by financial authorities, government agencies, and social network platforms themselves. Failure to do so will result in fines or worse – complaints from your customers regarding privacy issues!

The Markets in Financial Instruments Directive II (MiFiD II) impacts how financial institutions can and must communicate, including on social media. As well as global or regional restrictions, certain social media networks have also imposed their own rules regarding financial promotion.

On Twitter, for example, binary options and cryptocurrencies are prohibited, while advertising of banking services is restricted. There are many other cases that you need to be aware of, for example, all advertisements in Russia need to be made in the Russian language, which causes extra work and compliance control.

Facebook is also subject to restrictions. While many areas are restricted or under control, some options like binary options and ICOs are banned.

If your financial business is in some of the dangerous zones, you might want to rethink your strategy or… prepare for a challenge.

Don’t forget to conduct social media audit

A social media audit is a process that every social media manager in the finance industry should be aware of. The more feedback you receive regarding your future social media strategy and social marketing plan from your target audience, the better it will assist in making decisions regarding future social strategies and social marketing plans.

Additionally, a social media audit is important for social networking sites to take into account changes in company or partnership policy and strategies, as well as to receive feedback from their own side about what was observed. This must be done regularly – at least once a year or after any major changes have been made to your social strategy.

Comparing social media benchmarks with competitors is an integral part of social media audit, and without it, the audit will not be successful.

If you know how they rank on social media among the target audience, such as what are the most popular platforms and how often they post, you can use these insights to improve upon them if necessary or when marketing towards specific groups that prefer certain platforms over others.

Comparing companies will not only reveal which one has had better results up to now, but that will also ensure that you know what will work best for your or your competitors’ businesses in the future, lifting your social media strategy to new heights.

Social media for finance: best practices

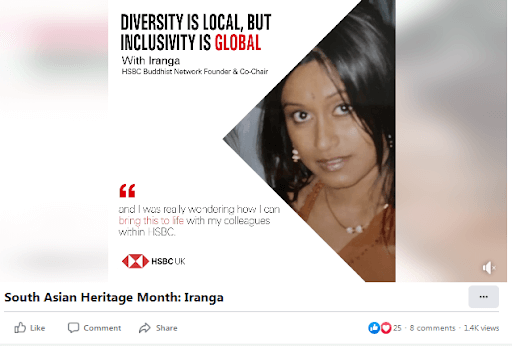

Show a human face

In spite of the fact that you may not always be able to leverage this, you should still strive to give your brand a human touch whenever you can. You could share internal initiatives on social media or bring your employees together. HSBC decided to celebrate South Asian Heritage Month by showing stories and comments from their employees on social media.

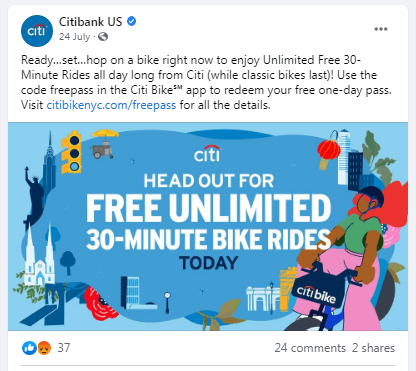

Get involved

Financial institutions often have a significant impact and a lot of opportunities to participate in social initiatives. By having time, money, resources, and networks, they can get involved with such activities, which can add a lot to their public relations, CSR, and recognition. By promoting free bike rides for New Yorkers, Citibank US demonstrated their involvement in the regular life of their clients (and provided environmental benefits!).

React in real-time

This rule could apply to anyone running their communication on social media, of course. In social media for finance, real-time reactions doesn’t just mean jumping on the latest trend, but also referring to unpleasant situations that may require your attention. Nationwide did that, showing how to file a claim after hurricane Ida.

Launch new products

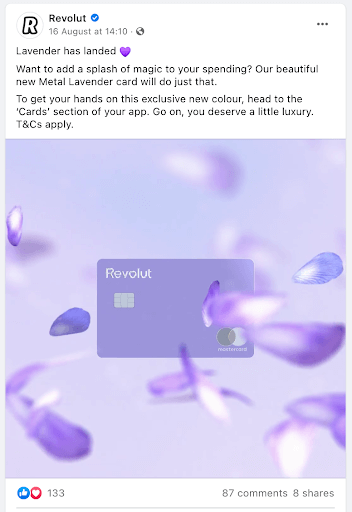

Social media is the perfect place to display your new products and services. You’ll have plenty of opportunities not only to showcase your offer, but also to receive feedback and answer early questions. As an example, Revolut created a beautiful social media animation to highlight their new card offering rather than releasing a dry press release.

Deliver value (blog posts)

Sharing relevant and educational content created across other platforms, even outside of social networks, is also easy via social media profiles. Like many other financial companies on social media, N26 is there to share tips and tricks that they hope will help their audience and, in some way, tie into their own financial solutions.

Experiment with formats

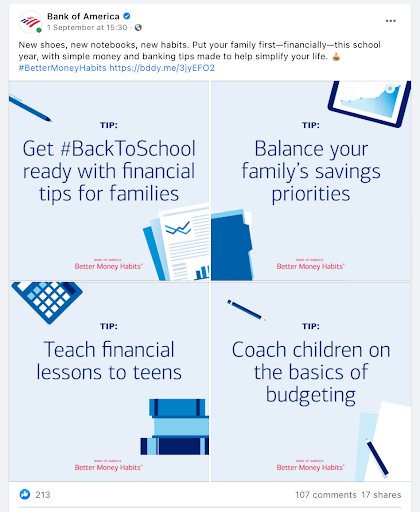

Ever-changing social media platforms provide financial companies with a variety of options that can be tested. New formats on their profiles are not a problem for Bank of America. An example of a collage that has four square photos displayed together to resemble a whole can be seen below.

Social media for finance: a curse or a blessing?

There are several challenges associated with social media for finance. A good social media strategy requires not only resources but constant execution too. You should also take care of customer service on social media, since your social media accounts can serve as active customer support channels. As well as that, compliance with country-specific legislation and social network regulations are both mandatory and considerably more strict than in many other industries.

However, facing these challenges can be very rewarding and quickly pay off with a loyal following, feedback about your services, and – not to forget – new clients.

We hope our tips will help you achieve this goal!